alameda county property tax senior exemption

To download and print a. Lookup or pay delinquent prior year taxes for or earlier.

Michael Barnes Albany City Council Meeting Comments And More Page 2

If you would like to request a copy of next years application to be.

. The state reimburses a part of the property taxes to eligible individuals. The system may be temporarily unavailable due to system maintenance and nightly processing. The Measure A parcel tax rate is 32 per.

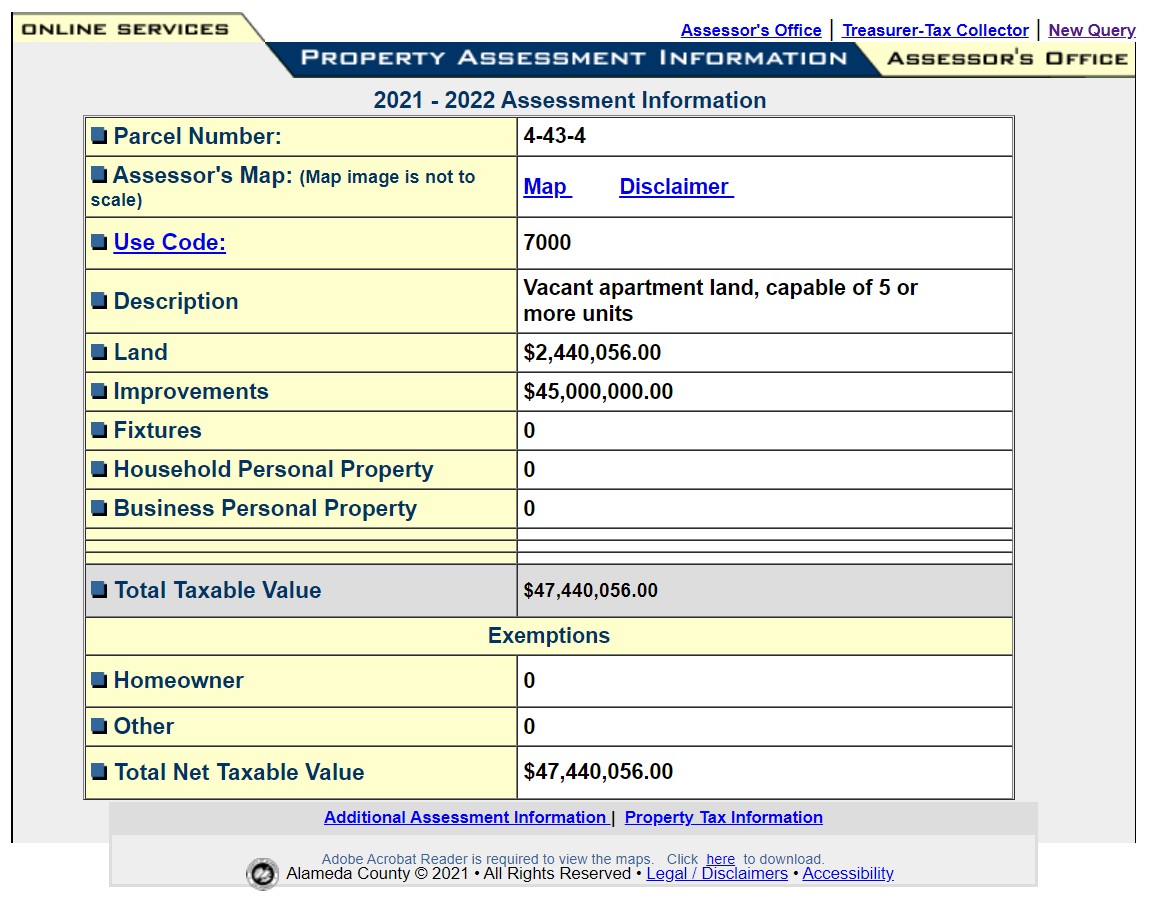

Cook leaders want property tax exemption crackdown law Cook County Board President Toni Preckwinkle and Assessor Joe Berrios on Tuesday urged state. Status Check and enter your Assessors Parcel Number APN from your Alameda County Property Tax Statement. 79 rows Transfer Your Tax Base.

Currently only 2021-22 Exemption and Refund Application. Some will grant an exemption retroactively for. Senior Exemption Waiver Measure I Deadline for filing for the 2022-2023 tax year was June 15 2022 430 pm.

Pay Lookup Property Taxes Online. Status Check and enter your Assessors Parcel Number APN from your Alameda County Property Tax Statement. Exemption of Leased Property Used Exclusively for Low-Income Housing.

2263 Santa Clara Avenue Room 220 Alameda CA 94501 The exemption discount will be applied 2 billing cycles after receipt of the application. Claim for Homeowners Property Tax Exemption. This program gives seniors 62 or older blind or disabled citizens the option of having the state pay all or part of the property taxes on their residence until the individual.

If you sold your home and purchased a new homehowever you must re-file for a Senior Citizen or SSI Exemption for thenew property. If you have any questions please call or email. This application form may be completed by the military service person hisher adult dependent or any other individual authorized by the service person to act on hisher behalf.

The tax type should appear in the upper left corner of your bill. Please contact our Office for. Low-income residents earning less than 13200 annually.

This generally occurs Sunday. Please choose one of the following tax types. If the exemption was previously granted and you no longer qualify for the exemption the law requires that you notify the Assessors Office as soon as possible.

If you sell that home for 700000 and move into a new place valued at 650000 you would still. Most require seniors to apply by a certain date often in May or June to get an exemption for the tax year that starts July 1. Claim for Disabled Veterans Property Tax Exemption.

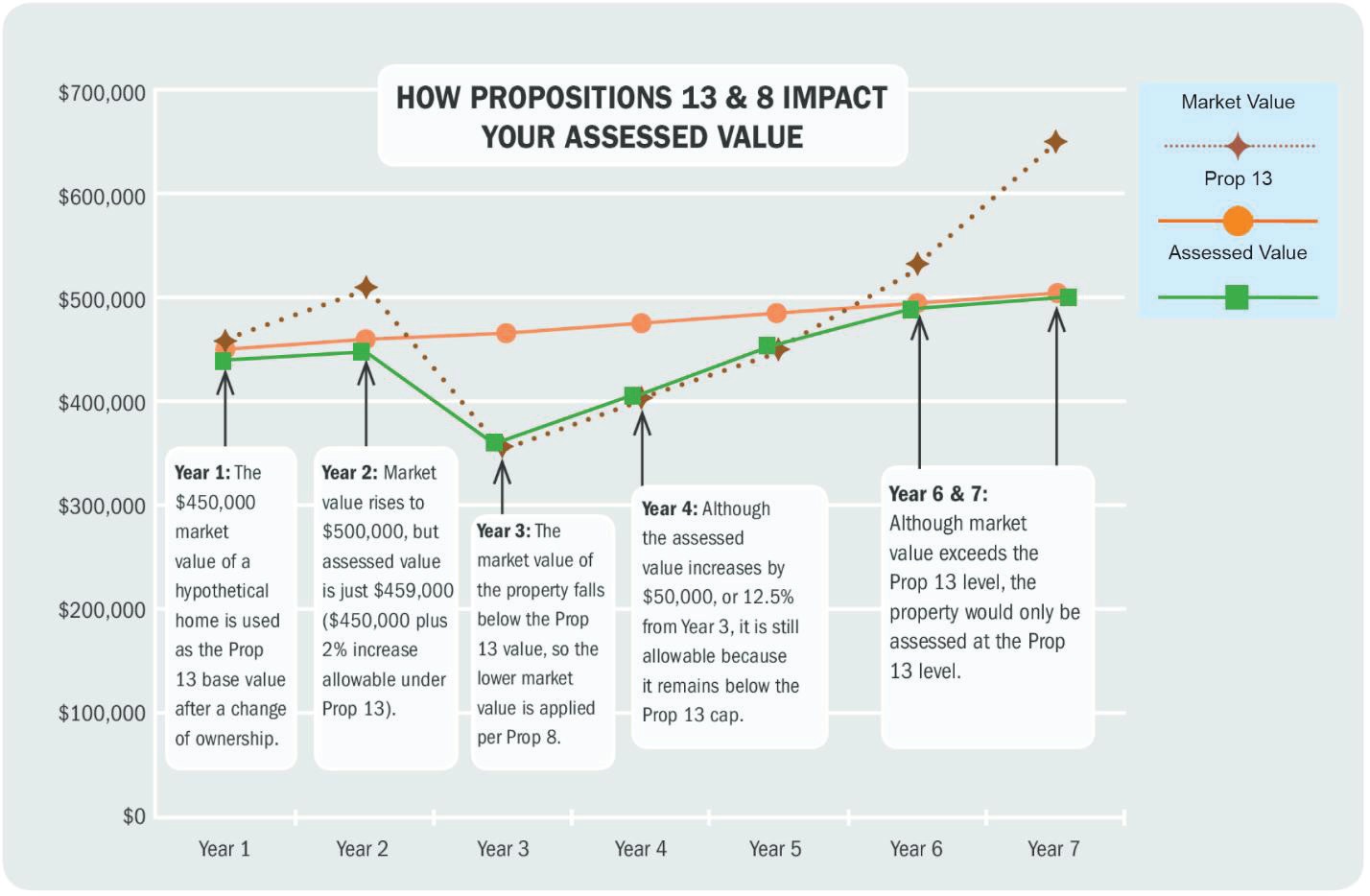

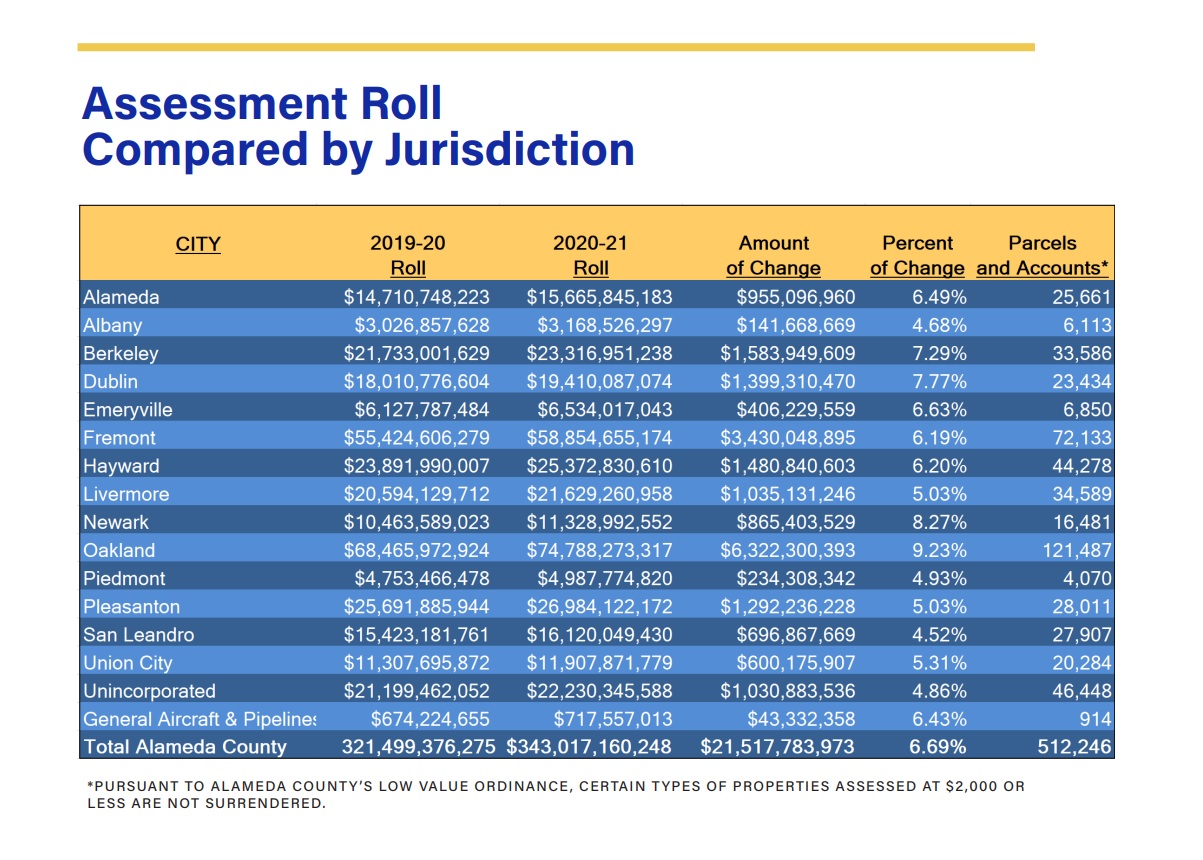

Senior Citizens Disabled Persons Under certain conditions persons aged 55 and older or severely disabled persons of any age may transfer the Proposition 13 factored base year value. Year 20222023 Property Tax Statement from Alameda County will have the following special assessment removed or. Alameda county property tax.

An annual savings of 70 can buy 26 cups of coffee 25 gallons of gasoline dinner and a movie or 2 gallons of paint to brighten the look of a home. Seniors 62 or older Blind and disabled citizens. Senior Citizens.

Assuming your tax rate is around 125 youre paying 4571 in taxes each year. The exemption application has been approved for Measure Z only. Currently only 2022-23 Exemption statuses are shown.

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Horgan Seniors Be Aware Of A Possible Tax Exemption

What Is The Veterans Property Tax Exemption The Ascent By Motley Fool

Alameda County Ca Property Tax Calculator Smartasset

Acgov Org Alameda County Government

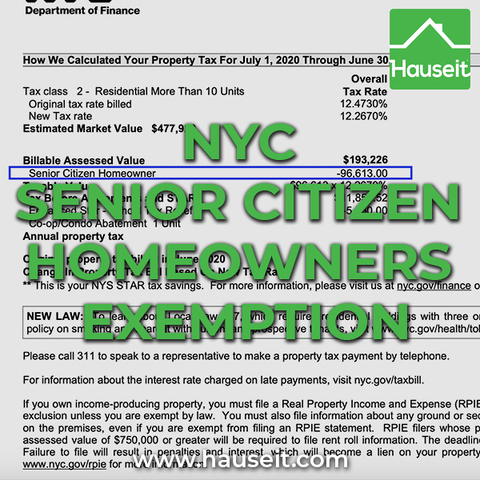

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Important California Property Tax Exemptions For Seniors Homehero

City Of Oakland Check Your Property Tax Special Assessment

Opinion Berkeley Homeowners May Be Eligible For A Property Tax Refund

California Property Taxes Explained Big Block Realty

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Claim For Reassessment Exclusion For Transfer Between Parent And Child Ccsf Office Of Assessor Recorder

Community Facilities District No A C 3 Myparceltax

Opinion Berkeley Homeowners May Be Eligible For A Property Tax Refund

Alameda Seniors Measure A Parcel Tax Exemption Deadline Approaching Alameda Ca Patch

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates